We continue to hear predictions from homeowners (buyers) that the market is going to crash... Is it wishful thinking or are there some truth to that?

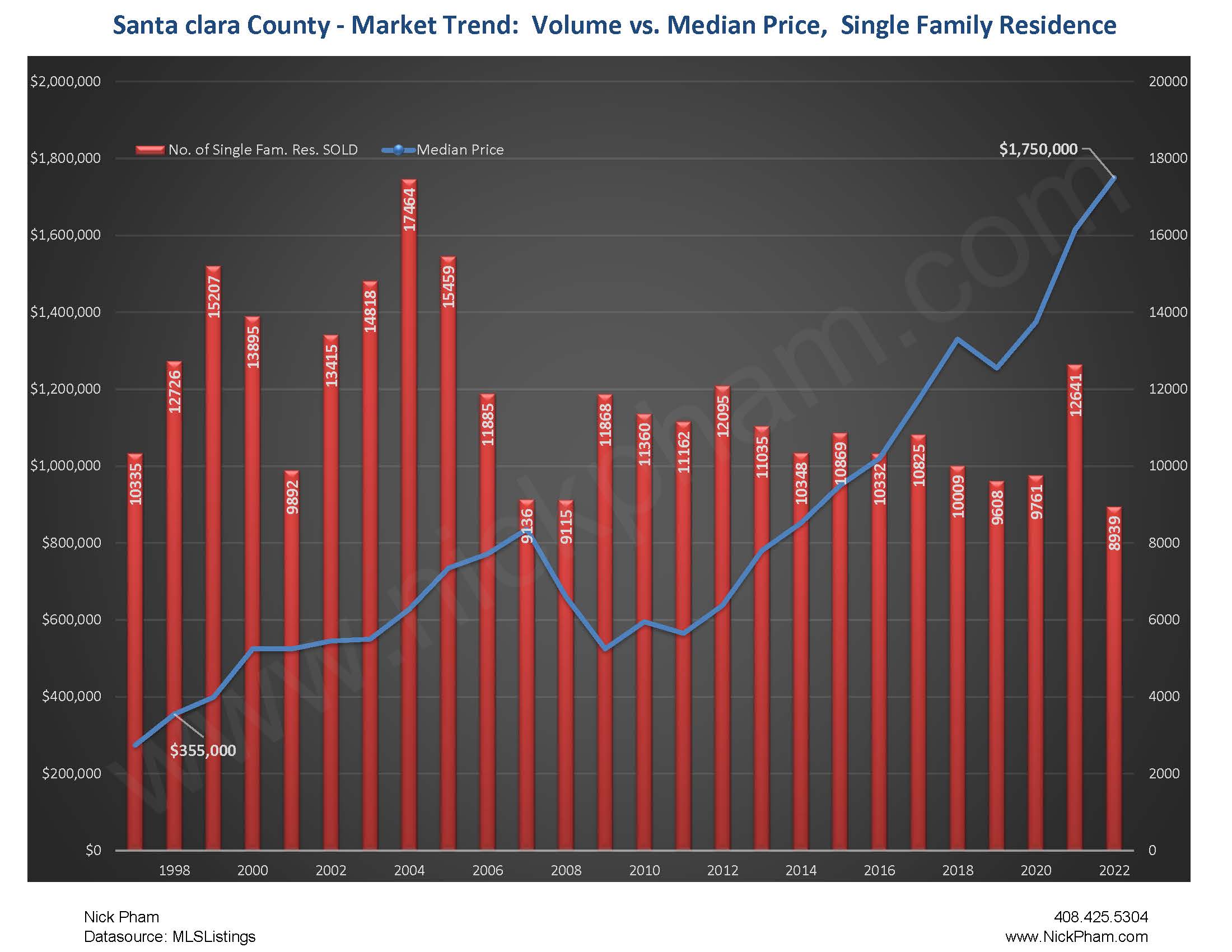

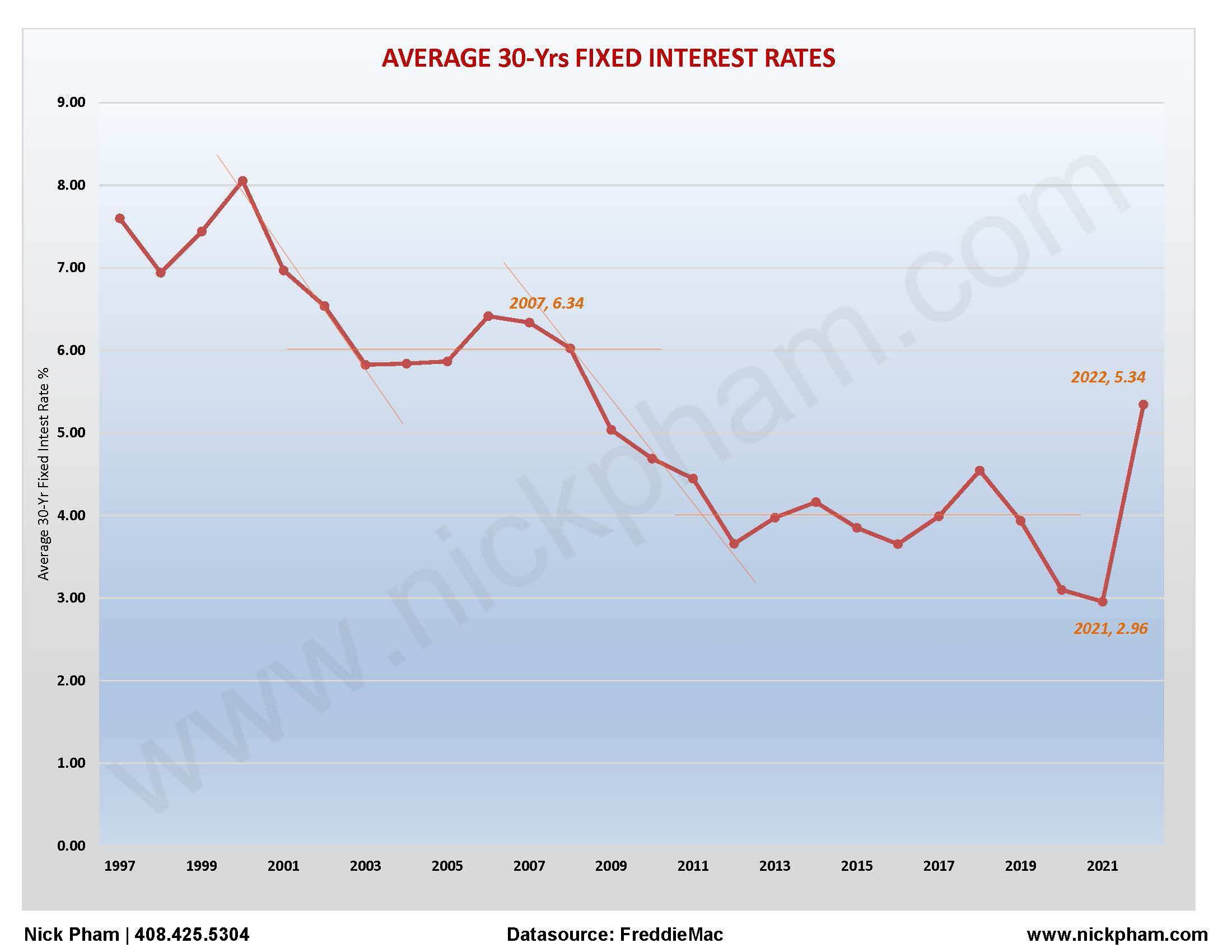

With the interest rates almost double in 2022, most homeowners expect that home sales will decline. As predicted in my previous blogs, I did expect the market to go through an adjustment, not by price but by units volume. The market did slow down, as for the number of homes sold. But the Median sale price of the homes sold did not see a significant change. FYI, the median sale price (vs. average) measures the “middle” price, meaning that half of the homes sold for a higher price and half sold for less. Median price are better trend indicator.

What is my prediction for 2023? What will the Federal Reserve do? If the Fed continues to keep their rates at the same @ 4.25% to 4.50% level, we should continue to see 30 years fixed consumer mortgage interest rates to hover around 6.00%-6.25%. (Banks make ~ 2.0-3.0% on the interest rates they get from the Fed). This interest rates level is actually the “norm”. The marking is adjusting to the norm. We are seeing a market correction, and it will be different for the different markets/locations.

For higher cost area like San Francisco Bay Area, that saw the 30-40% increase in 2020 & 2021, we should expect to see a decline. But should we expect a decline of 30-40% to offset the increase seen? The answer is “No”. When the Fed rates dropped to ~ 0.00-0.25% (or 2.00-3.00% consumer’s mortgage rates) during COVID, homeowners had refinanced their mortgage to the lowest rates possible. The low interest rates benefited all buyers tremendously during the same period. These homeowners make lower mortgage payments to maintain their equities. They have no reasons to sell their homes low. Thus, the demand and supply model continues to hold true especially for the Bay Area real estate market. Demand for housing remains high. City of San Jose plans to add +77,000 new homes ove the next decade, to meet the needs for housing.

So what does it take to buy or sell in this dynamic market? A solid strategy. With a good strategy, seller can sell their homes for the highest value. And buyers can still buy their dream homes with proper financing planning.

For sellers, what does it take to sell your home in the current dynamic market? The “right” home, the “right” marketing strategy are keys. Many homes are still selling over their asking price. I can help make your home the “right” home, to sell for top dollars.

For Buyers, the interest rates we see today will not go back down to the level it was a year ago. This is the norm. However, there are creative loan programs such as the rate buy-down to help you qualify. You can prepare by knowing your buying power. Having a realtor with market knowledge and good negotiation skills, will help you achieve your homeownership dream.

Historical data has shown that properties continue to sell regardless of interest rates, and home values continue to increase over a long period of time. The market is dynamic. Real Estate has been and will continue to be the safest long-term investment.

I am a resource that you count on. I can provide you with knowledge to empower you to make the best decision.

Nick Pham | Real Estate & Mortgage Broker | DRE.0165281