While some of us pray for the market to decline, it is not likely that it will anytime soon. What do I mean by this?

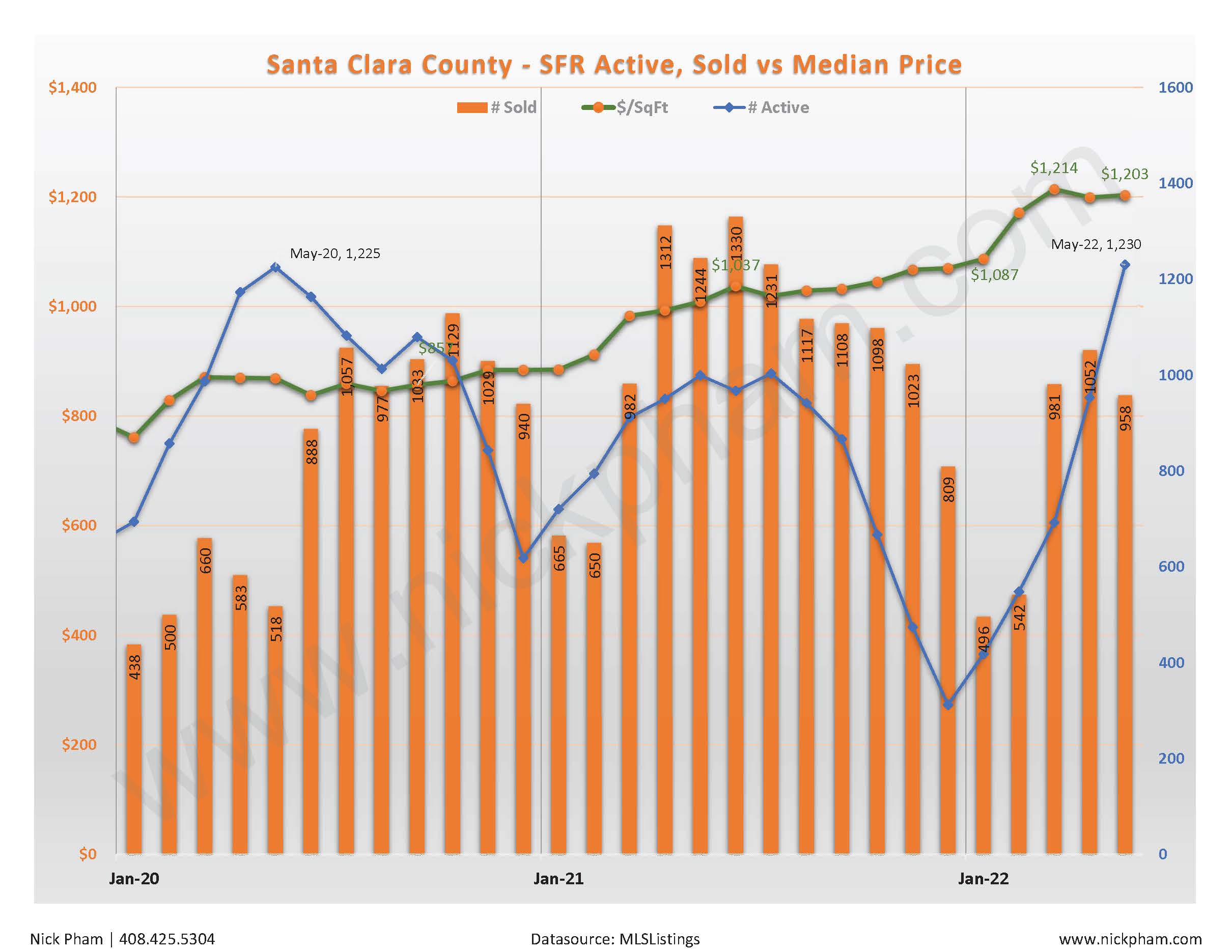

1. With the recent increase in interest rates, home sales have slow down as expected, meaning that # of homes for sales (active) is more and they take a bit longer to sell.

2. As of end of May 2022, there are only 1,230 homes (single dwelling) for sale for a county of over 1.9M people. Increase in inventory is typical as we head into the busy summer months.

3. Sale price remain competitive. The right home, right location still sale with multiple offers, over asking.

4. Interest rates are now at the normal/average level prior to COVID. The below average Interest Rates observed was only temporary to keep during COVID. Did it cause inflation? That's another topic of discussion.

Most homeowners have leveraged the low interest rates to REFI and New homeowners purchased with 20% down payment... What is the chances of these homeowners risking their hefty +20% equity, not making their lower monthly payment to lose their home?

Of course, different markets may have different dynamics. For the #BayArea economy, employers/employees demands and weather, it has been a proven a lower risk market over the years...

@nickphamrealtor #topsanjoserealtor #sanjose #evergreensanjose #sanjoserealestate #realestate