It has been the question that everyone is asking for the past 10 years, and the market has proven many of us wrong over and over. Since the last market crash in 2008-2010, many have attempted to answer this questions. I myself included, and have I been wrong – YES!!!

I have been following the market trend, and created my own graphs for as long as could remember. The engineering mind of mine never left me, even after I left the high tech industry. I have found it useful in helping my clients make the best informed decisions.

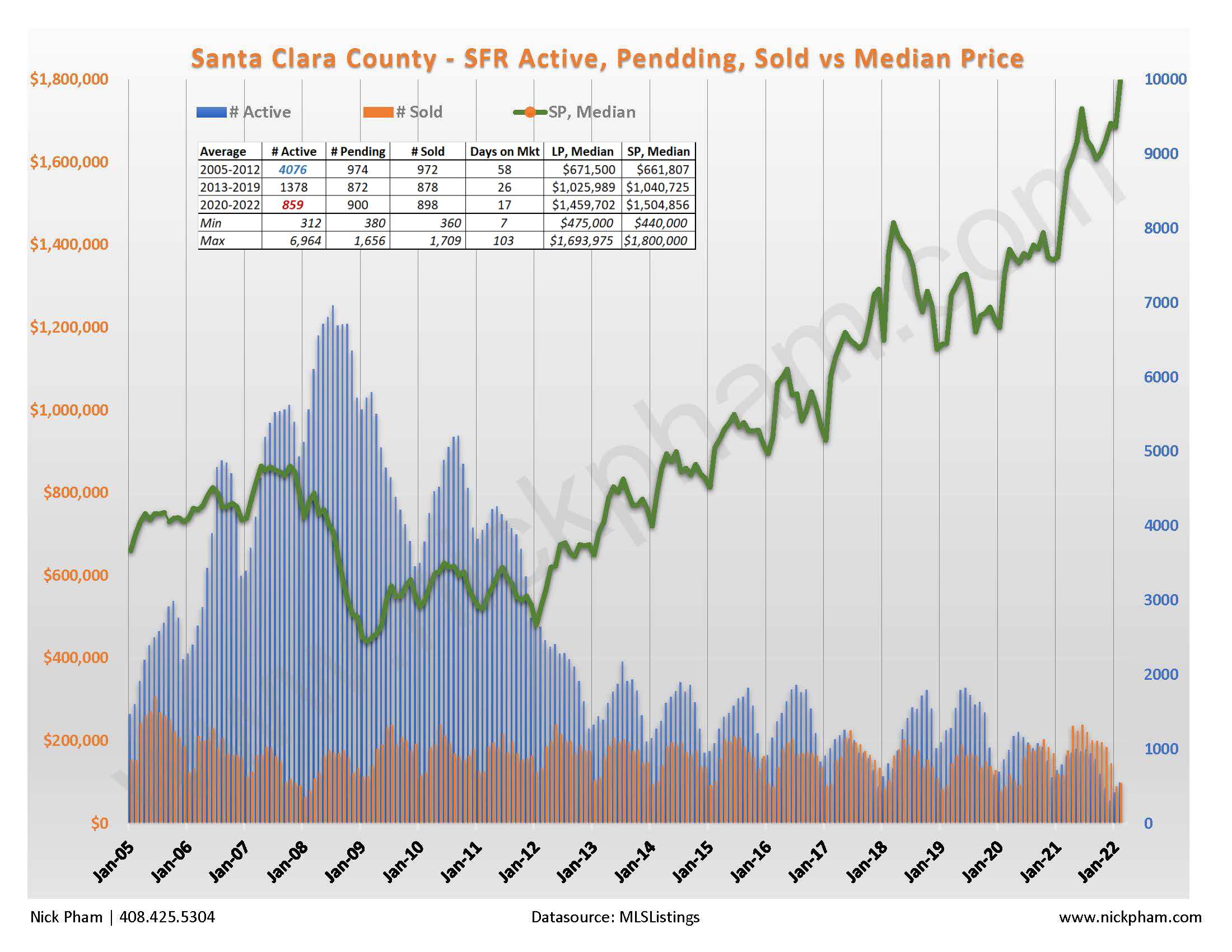

For general purpose, I am only sharing the statistic for Single Family Residence (SFR) in Santa Clara County, here. Between 2005-2012 the average # of home for sale was 4,076 per month. Between 2013-2019, the average dropped to 1,378 home for sale. And within the last 2 years 2019-2021, that average drop to 859 homes for sale only! For a County of roughly 1.9M people, do you think there is still a high demand for housing?

If you have lived in the Bay Area long enough to experience the market crash in 2008-09, you may remember how fast it recovered! The data is not showing me that will “crash” anytime soon. Why?

The crash in 2008 was mostly due to the subprime lending crisis offered at that time. When the average borrowers can buy a home at “Zero-Down” and/or with an “Option-ARM” loan programs, it was a great way for the average family to buy vs rent. When the “Optional” interest rate adjusted to the market level, most were no longer able to pay their mortgages, thus the foreclosures and short-sale! I have looked and shared market data via my blogs, etc. and I can let you know that most homeowners that purchased their homes with 20% down payment did not lose their home during that time. I am proud to say that none of my clients ever foreclosed or short-sale their homes during that past 20 years.

After the reformed of the mortgage industry in ~ 2011, almost all lenders will lend 80%, requiring borrowers to bring in 20% down payment. The risk is therefore with the homeowner, as most will not walk away, and lose their 20% equity in their home. If you are buying a home to live in and plan to keep it for 5+ years, you need to capitalize of the low interest we still have. Long term risks for real estate investment (primary home or rental) are minimal to none. If you are an investor, looking to “flip”, your guesses are as good as good your risk tolerance!

There are still many buyers looking for a home while the interest rates are still low. If you are thinking of selling, maybe 2022 is your best year! As interest rates go up, the buying power will drop, and that could mean a “slow down”… I do not expect a drop or “crash” that we saw in 2008-09 where the median price drop from $800,000 to $400,000.

Love to hear your thoughts… and if I could help get you home sold for the highest, please contact me.

Nick Pham, Broker

#topsanjoserealtor #sanjoserealeste #realestatemarket #markettrend #marketcrash #optionarm